Multiple Choice

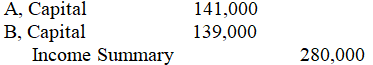

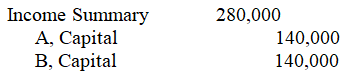

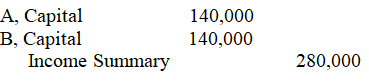

Partners A and B receive a salary of $16,000 and $14,000,respectively.They agree to share income and losses equally.If the partnership has income of $280,000 in 20x5,the entry to close the income into their capital accounts is:

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q58: Joint ventures<br>A)have become outmoded<br>B)are a form of

Q59: Elliot and Jessica are about to liquidate

Q60: Zach has bought Biannca's interest in the

Q61: Which of the following does not result

Q62: In a limited partnership<br>A)the general partners have

Q64: Avery and Bert are partners who share

Q65: Warren and Spencer are partners in a

Q66: Partnership liquidation is not the same as

Q67: When a partner leaves a partnership,it is

Q68: There is no income tax imposed on