Paul,Quinn,and Ralph Have Equities in a Partnership of $120,000,$180,000,and $100,000,respectively,and

Essay

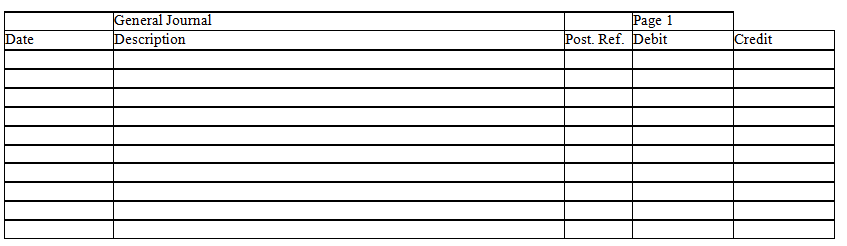

Paul,Quinn,and Ralph have equities in a partnership of $120,000,$180,000,and $100,000,respectively,and share income and losses in a ratio of 2:1:2,respectively.The partners have agreed to admit Sandy to the partnership.Prepare entries in journal form without explanations to record the admission of Sandy to the partnership under each of the following assumptions:

a.Sandy invests $100,000 for a 30 percent interest,and a bonus is recorded for Sandy.

b.Sandy invests $150,000 for a one-fifth interest,and a bonus is recorded for the old partners.

Correct Answer:

Verified

Correct Answer:

Verified

Q83: When a withdrawing partner withdraws assets less

Q84: When salary and interest allocations exceed net

Q85: The division of partnership profits on the

Q86: As long as the action is within

Q87: Eddie and Lauren are partners in a

Q89: Partners' Withdrawals accounts have normal debit balances.

Q90: Joan pays Eva $60,000 for her $40,000

Q91: A partner has a capital balance of

Q92: The ability of a partner to enter

Q93: After selling all the assets and paying