Jordan,Kyle,and Noah Have Equities in a Partnership of $100,000,$160,000,and $140,000,respectively,and

Essay

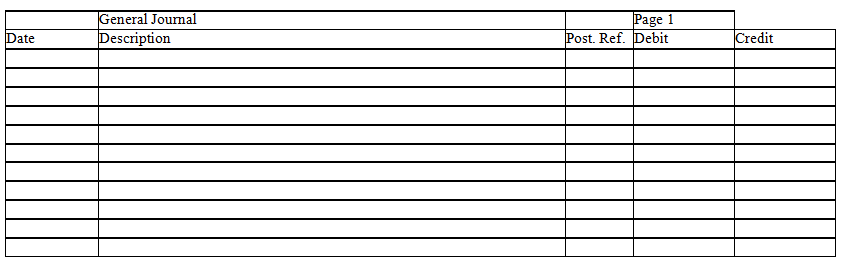

Jordan,Kyle,and Noah have equities in a partnership of $100,000,$160,000,and $140,000,respectively,and share income and losses in a ratio of 5:3:2,respectively.The partners have agreed to admit Billy to the partnership.Prepare entries in journal form without explanations to record the admission of Billy to the partnership under each of the following assumptions:

a.Billy invests $80,000 for a 25 percent interest,and a bonus is recorded for Billy.

b.Billy invests $160,000 for a one-fifth interest,and a bonus is recorded for the old partners.

Correct Answer:

Verified

Correct Answer:

Verified

Q70: Which of the following is incorrect regarding

Q71: When a partner withdraws from a partnership,an

Q72: Income and losses are divided equally among

Q73: List four advantages and four disadvantages of

Q74: Justin and Nicole are forming a partnership.What

Q76: An advantage of the partnership form of

Q77: April and Cammy are partners who have

Q78: Noncash assets invested into a partnership are

Q79: In a limited partnership,the general partner's liability

Q80: Partners A and B receive a salary