Essay

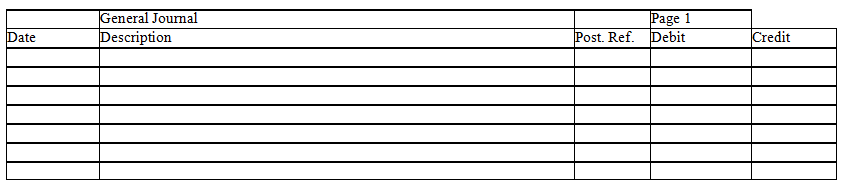

X,Y,and Z are partners who share profits and losses in a ratio of 1:2:3,respectively.Z's Capital account has a $60,000 balance.X and Y have agreed to let Z take $78,000 of the company's cash when he retires.Prepare an entry in journal form without explanation to record Z's exit,including the recognition of a bonus to Z

Correct Answer:

Verified

Correct Answer:

Verified

Q47: One of the benefits of forming a

Q48: Chelsea,Jack,and Connor have a partnership.Chelsea wishes to

Q49: Only not-for-profit organizations form joint ventures.

Q50: Admission of a new partner never has

Q51: When a partner invests assets other than

Q53: There are several types of business organizations

Q54: It is possible to allocate income or

Q55: When a partner invests assets in a

Q56: Elise,Farrah,and Gina are liquidating their business.They share

Q57: Fred,Kristina,and Nick each receive a $14,000 salary,as