Essay

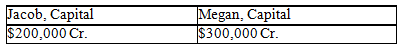

Jacob and Megan are partners who share profits and losses in a ratio of 2:3,respectively,and have the following capital balances on September 30,20x5: The partners agree to admit Mitchell to the partnership.Calculate the capital balances of each partner after the admission of Mitchell,assuming that bonuses are recorded when appropriate for each of the following assumptions:

The partners agree to admit Mitchell to the partnership.Calculate the capital balances of each partner after the admission of Mitchell,assuming that bonuses are recorded when appropriate for each of the following assumptions:

a.Mitchell pays Jacob $100,000 for 40 percent of his interest

b.Mitchell invests $100,000 for a one-sixth interest in the partnership

c.Mitchell invests $100,000 for a 25 percent interest in the partnership

d.Mitchell invests $100,000 for a 15 percent interest in the partnership

Correct Answer:

Verified

a.Jacob,$120,000 Megan,$300,00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q143: Alex,Clinton,and Evan are in a partnership.Evan decides

Q144: A limited partnership normally has one or

Q145: Juan invests $120,000 for a one-fifth interest

Q146: In some liquidations,a partner's share of the

Q147: Discuss how each of the following would

Q148: Brandi and Hunter divide partnership income and

Q149: Business organizations that mimic the characteristics of

Q150: Partners S,T,and U share income and losses

Q151: Which of the following is a characteristic

Q153: Partnership income or loss can be divided