Multiple Choice

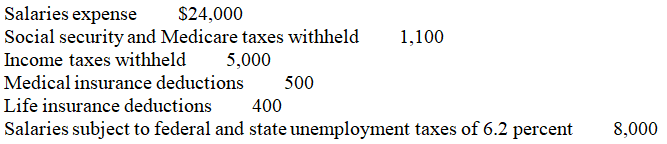

Use this information to answer the following question. The following totals for the month of September were taken from the payroll register of Meadors Company:

The entry to record the accrual of federal unemployment tax (assume FUTA tax of 0.8 percent) would include a

A) credit to Federal Unemployment Tax Payable for $64.

B) debit to Federal Unemployment Tax Payable for $64.

C) debit to FUTA Tax Expense for $64.

D) credit to Payroll Taxes and Benefits Expense for $64.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: The classification of a liability as current

Q18: For notes payable whose interest is stated

Q19: The term salaries refers to the compensation

Q20: All factors in a present value of

Q21: Common examples of commitments are leases and

Q23: Gross earnings minus deductions equal take-home pay.

Q24: The amount of property tax payable is

Q25: A liability is recognized when<br>A)the exact due

Q26: Which of the following is not a

Q27: Identify and briefly discuss the three approaches