Multiple Choice

Of a company's employees,50 percent typically qualify to receive two weeks' paid vacation a year (50 weeks) .The entry to record the estimated liability for vacation pay for a week in which the total payroll is $8,800 would be

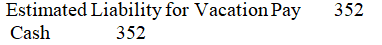

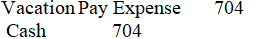

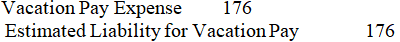

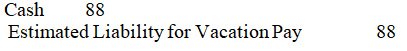

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q31: All of the following are estimated liabilities

Q32: Use this information to answer the following

Q33: The payables turnover is measured<br>A)in days.<br>B)as a

Q34: Lease agreements are<br>A)estimates.<br>B)commitments.<br>C)liabilities.<br>D)contingencies.

Q35: Liabilities that might arise from which of

Q37: Sales Tax Payable is an example of

Q38: An ordinary annuity is a series of

Q39: Current liabilities are debts that are expected

Q40: Use this information to answer the following

Q41: A commitment is a legal obligation that