Multiple Choice

Lewis Company purchased a machine for $60,000.The machine has an estimated life of 20,000 hours and no salvage value.The entry to record the depreciation charge under the production method assuming that the machine was used for 4,000 hours is:

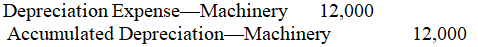

A)

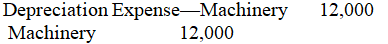

B)

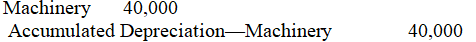

C)

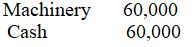

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q131: Which of the following is not a

Q132: If the carrying value of goodwill is

Q133: Management has considerable latitude in making judgments

Q134: If a company's free cash flow is

Q135: The cost of assets acquired for a

Q137: The depreciable cost of an asset is<br>A)the

Q138: Chow Company sold a car for $18,100.The

Q139: According to generally accepted accounting principles,the proper

Q140: An intangible asset with a determinable useful

Q141: On January 1,a machine with a useful