Essay

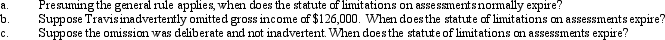

For the tax year 2010,Travis reported gross income of $500,000 on his timely filed Federal income tax return.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q49: If a special agent becomes involved in

Q62: The principal objective of the FUTA tax

Q81: The Federal gas-guzzler tax applies only to

Q116: Various tax provisions encourage the creation of

Q129: In spite of legislative changes which phase

Q132: Under the Tax Relief Reconciliation Act of

Q134: On transfers by death,the Federal government relies

Q136: A characteristic of FICA is that:<br>A)It is

Q137: Stealth taxes have the effect of generating

Q142: For Federal income tax purposes, there never