Essay

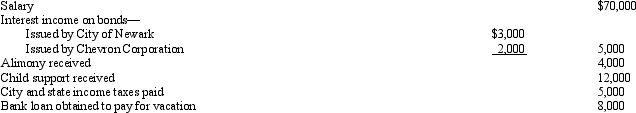

Emma had the following transactions during 2010:

What is Emma's AGI for 2010?

What is Emma's AGI for 2010?

Correct Answer:

Verified

$76,000.$70,000 (salary)+ $2,000 (intere...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$76,000.$70,000 (salary)+ $2,000 (intere...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q72: When the kiddie tax applies, the child

Q105: The major advantage of being classified as

Q111: In 2010,Sylvia had the following transactions: <img

Q113: The additional standard deduction for age and

Q114: For the past few years,Corey's filing status

Q115: In 2010,Warren sold his personal use automobile

Q116: Which of the following taxpayers may file

Q117: Katelyn is divorced and maintains a household

Q128: Once a child reaches age 19, the

Q185: When the kiddie tax applies and the