Essay

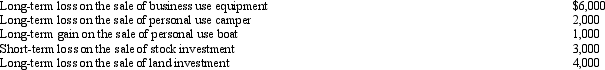

During the year,Marcus had the following transactions:

How are these transactions handled for income tax purposes?

How are these transactions handled for income tax purposes?

Correct Answer:

Verified

Ordinary loss of $6,000 on the business ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Ordinary loss of $6,000 on the business ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q28: Clara,age 68,claims head of household filing status.If

Q30: Lee,a citizen of Korea,is a resident of

Q31: Benjamin,age 16,is claimed as a dependent by

Q32: During 2010,Marvin had the following transactions: <img

Q34: After paying down the mortgage on their

Q35: During 2010,Carmen had salary income of $90,000

Q36: The Hutters filed a joint return for

Q37: Muriel,age 70 and single,is claimed as a

Q38: It is possible for an individual taxpayer

Q39: A child who is married can be