Multiple Choice

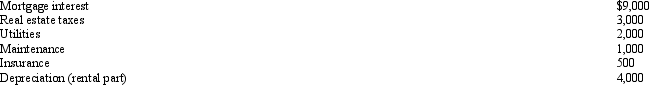

Robyn rents her beach house for 60 days and uses it for personal use for 30 days during the year.The rental income is $6,000 and the expenses are as follows:  Using the IRS approach,total expenses that Robyn can deduct on her tax return associated with the beach house are:

Using the IRS approach,total expenses that Robyn can deduct on her tax return associated with the beach house are:

A) $0.

B) $6,000.

C) $8,000.

D) $12,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Landscaping expenditures on new rental property are

Q43: Briefly explain why interest on money borrowed

Q48: Payments by a cash basis taxpayer of

Q59: For an expense to be deducted as

Q93: Legal expenses incurred in connection with rental

Q102: Using his bank credit card,Seneca,a cash method

Q106: In preparing his 2010 Federal income tax

Q107: Which of the following is correct?<br>A)A personal

Q107: In January, Lance sold stock with a

Q111: Sarah incurred the following expenses for her