Essay

During the year,Martin rented his vacation home for three months and spent one month there.Gross rental income from the property was $5,000.Martin incurred the following expenses: mortgage interest,$3,000;real estate taxes,$1,500;utilities,$800;maintenance,$500;and depreciation,$4,000.Compute Martin's allowable deductions for the vacation home.

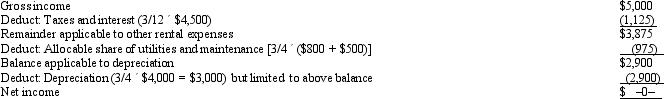

Since the vacation home is rented for 15 or more days and is used for personal purposes for more than the greater of (1)14 days or (2)10% of the rental days,the deductions are scaled down,using the court's approach,as follows:

Correct Answer:

Verified

Thus,Martin may deduct $1,125 taxes and ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q49: Payment of expenses by a cash basis

Q50: If an item such as property taxes

Q51: A taxpayer in the 25% tax bracket

Q52: Saul is single,under age 65,and has gross

Q55: Which of the following statements is correct?<br>A)If

Q57: Rob,a shareholder-employee of Falcon,Inc. ,receives a $300,000

Q58: A taxpayer who claims the standard deduction

Q73: A hobby activity can result in all

Q77: Briefly explain the provisions regarding the deductibility

Q91: If a vacation home is classified as