Essay

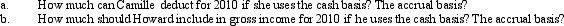

Camille,a calendar year taxpayer,rented a building from Howard for use in her business on November 1,2010.Camille paid $30,000 for 15 months' rent and a $2,500 damage deposit.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: Ordinary and necessary business expenses, other than

Q10: Which of the following statements is correct

Q58: Susan is a sales representative for a

Q76: A baseball team that pays a star

Q78: Generally, a closely held family corporation is

Q121: If a taxpayer makes a profit in

Q125: Fines paid in the course of carrying

Q125: Which of the following are deductions for

Q129: For purposes of the § 267 loss

Q131: Because Scott is three months delinquent on