Multiple Choice

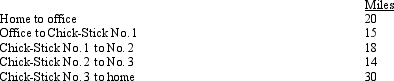

Michael is the city sales manager for "Chick-Stick," a national fast food franchise.Every working day,Michael drives his car as follows:  Michael's deductible mileage is:

Michael's deductible mileage is:

A) 0 miles.

B) 30 miles.

C) 47 miles.

D) 77 miles.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A participant has an adjusted basis of

Q19: Which,if any,of the following expenses is subject

Q21: What originally led to the cutback adjustment?

Q22: Emma holds two jobs and attends graduate

Q26: Sammy,age 31,is unmarried and is not an

Q27: Corey performs services for Sophie.Which,if any,of the

Q28: A taxpayer who claims the standard deduction

Q29: A taxpayer who always claims the standard

Q91: Both traditional and Roth IRAs possess the

Q104: Allowing for the cutback adjustment (50% reduction