Multiple Choice

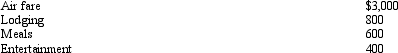

During the year,Peggy went from Nashville to Quito (Ecuador) on business.She spent four days on business,two days on travel,and four days on vacation.Disregarding the vacation costs,Peggy's unreimbursed expenses are:  Peggy's deductible expenses are:

Peggy's deductible expenses are:

A) $2,500.

B) $2,800.

C) $3,100.

D) $4,300.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Employees who render an adequate accounting to

Q95: In terms of IRS attitude,what do the

Q96: Travel status requires that the taxpayer be

Q97: Faith just graduated from college and she

Q98: In some cases it may be appropriate

Q99: Amy lives and works in St.Louis.In the

Q100: The portion of the office in the

Q102: In connection with the office in the

Q103: If a married taxpayer is an active

Q141: In which, if any, of the following