Multiple Choice

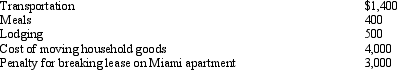

Due to a merger,Allison transfers from Miami to Chicago.Under a new job description,she is reclassified from employee to independent contractor status.Her moving expenses,which are not reimbursed,are as follows:  Allison's deductible moving expense is:

Allison's deductible moving expense is:

A) $0.

B) $5,900.

C) $6,100.

D) $8,900.

E) $9,300.

Correct Answer:

Verified

Correct Answer:

Verified

Q76: Lloyd, a practicing CPA, pays tuition to

Q113: Every year, Penguin Corporation gives each employee

Q115: In May 2010,after 11 months on a

Q118: A statutory employee is a common law

Q119: Amanda takes three key clients to a

Q121: The Federal per diem rates that can

Q122: Dan is employed as an auditor by

Q123: Which,if any,of the following expenses are not

Q124: Which,if any,of the following expenses is subject

Q134: Christopher just purchased an automobile for $40,000