Multiple Choice

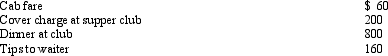

Henry entertains several of his key clients on January 1 of the current year.Expenses paid by Henry are as follows:  Presuming proper substantiation,Henry's deduction is:

Presuming proper substantiation,Henry's deduction is:

A) $1,220.

B) $740.

C) $640.

D) $610.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q15: How are combined business/pleasure trips treated for

Q17: Under the right circumstances, a taxpayer's meals

Q109: Felicia,a recent college graduate,is employed as an

Q112: There is reason to believe that many

Q113: Every year, Penguin Corporation gives each employee

Q115: In May 2010,after 11 months on a

Q118: A statutory employee is a common law

Q119: Amanda takes three key clients to a

Q121: The Federal per diem rates that can

Q161: Ethan, a bachelor with no immediate family,