Essay

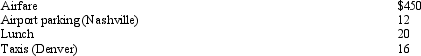

Roberto,a self-employed patent attorney,flew from his home in Nashville to Denver,had lunch alone at the airport,conducted business in the afternoon,and returned to Nashville in the evening.His expenses were as follows:

What is Roberto's deductible expense for the trip?

What is Roberto's deductible expense for the trip?

Correct Answer:

Verified

$478 ($450 + $12 + $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: A taxpayer who uses the automatic mileage

Q13: In choosing between the actual expense method

Q29: A taxpayer who always claims the standard

Q31: After she finishes working at her main

Q31: If a taxpayer does not own a

Q32: A taxpayer has multiple jobs at different

Q33: Daniel just graduated from college.The cost of

Q35: Evan is employed as an assistant manager

Q38: Dirk has $228,000 of earned income in

Q39: In November 2010,Katie incurs unreimbursed moving expenses