Essay

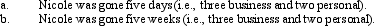

Nicole went to London on business.While there,she spent 60% of the time on business and 40% on vacation.How much of the air fare of $5,000 can she deduct based on the following assumptions:

Correct Answer:

Verified

Transportation costs for mixed use (i.e...

Transportation costs for mixed use (i.e...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Elaine, the regional sales director for a

Q86: A taxpayer who lives and works in

Q87: Ryan performs services for Jordan.Which,if any,of the

Q88: Rachel lives and works in Chicago.She is

Q89: The § 222 deduction for tuition and

Q93: When using the automatic mileage method,which,if any,of

Q95: In terms of IRS attitude,what do the

Q109: Janet, who lives and works in Newark,

Q114: For self-employed taxpayers, travel expenses are not

Q150: A worker may prefer to be treated