Essay

Rocky has a full-time job as an electrical engineer for the city utility.In his spare time,Rocky repairs TV sets in the basement of his personal residence.Most of his business comes from friends and referrals from former customers,although occasionally he runs an ad in the local suburbia newspaper.Typically,the sets are dropped off at Rocky's house and later picked up by the owner when notified that the repairs have been made.

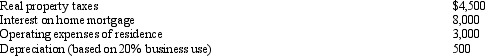

The floor space of Rocky's residence is 2,500 square feet,and he estimates that 20% of this is devoted exclusively to the repair business.Gross income from the business is $12,000,while expenses (other than home office)are $5,000.Expenses relating to the residence are as follows:

What is Rocky's net income from the repair business?

What is Rocky's net income from the repair business?

Correct Answer:

Verified

Correct Answer:

Verified

Q2: A taxpayer who uses the automatic mileage

Q21: The tax law specifically provides that a

Q31: If a taxpayer does not own a

Q35: Evan is employed as an assistant manager

Q38: Dirk has $228,000 of earned income in

Q39: In November 2010,Katie incurs unreimbursed moving expenses

Q41: Bob lives and works in Newark,NJ.He travels

Q42: For the current football season,Rail Corporation pays

Q44: An employed taxpayer can avoid the cutback

Q89: By itself, credit card receipts will constitute