Multiple Choice

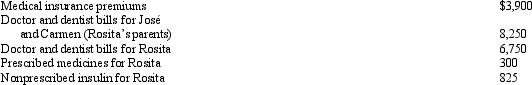

Rosita is employed as a systems analyst.For calendar year 2010,she had AGI of $120,000 and paid the following medical expenses:  José and Carmen would qualify as Rosita's dependents except that they file a joint return.Rosita's medical insurance policy does not cover them.Rosita filed a claim for $3,150 of her own expenses with her insurance company in December 2010 and received the reimbursement in January 2011.What is Rosita's maximum allowable medical expense deduction for 2010?

José and Carmen would qualify as Rosita's dependents except that they file a joint return.Rosita's medical insurance policy does not cover them.Rosita filed a claim for $3,150 of her own expenses with her insurance company in December 2010 and received the reimbursement in January 2011.What is Rosita's maximum allowable medical expense deduction for 2010?

A) $2,775.

B) $11,025.

C) $17,325.

D) $17,775.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Jerry pays $5,000 tuition to a parochial

Q44: Harry and Sally were divorced three years

Q45: Interest paid or accrued during the tax

Q47: In the year of her death, Maria

Q58: Employee business expenses for travel qualify as

Q60: Stewart,a calendar year taxpayer,pays $6,000 in medical

Q62: Phyllis,a calendar year cash basis taxpayer who

Q65: Your friend Scotty informs you that he

Q66: Ernie sold his personal residence to Amanda

Q68: Brad,who uses the cash method of accounting,lives