Essay

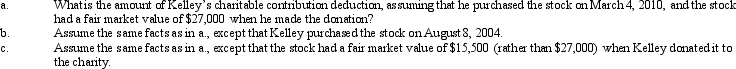

Kelley,who has AGI of $250,000,owns stock in Blue Corporation with a basis of $20,000.He donates the stock to a qualified charitable organization on July 5,2010.

Correct Answer:

Verified

General discussion.The deduction for a c...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Tony,a cash basis taxpayer,took out a 12-month

Q2: During the current year, Maria and her

Q3: Andrew was injured in an automobile accident

Q4: In 2010,Mary traveled 800 miles for specialized

Q5: Nancy had an accident while skiing on

Q6: Mel made the following donations to charity

Q9: A taxpayer pays points to obtain financing

Q11: On December 23,2010,Megan used her credit card

Q53: Pedro's child attends a school operated by

Q98: Fees for automobile inspections, automobile titles and