Essay

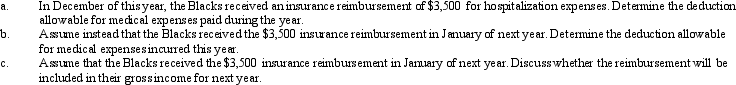

Paul and Patty Black are married and together have current AGI of $140,000.They have two dependents and file a joint return.During the year,they paid $8,000 for medical insurance,$15,000 in doctor bills and hospital expenses,and $1,000 for prescribed medicine and drugs.

Correct Answer:

Verified

General discussion.All of the following ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Grace's sole source of income is from

Q13: Pat died this year.Before she died, Pat

Q46: Medical expenses must relate to a particular

Q47: Betty owned stock in General Corporation that

Q48: In April 2010,Hiram,a calendar year cash basis

Q50: Georgia contributed $2,000 to a qualifying Health

Q51: Betty,who is an accounting firm partner,paid $4,800

Q52: Joseph and Sandra,married taxpayers,took out a mortgage

Q53: Dwayne contributed stock worth $17,000 to a

Q54: Antonio,who is single and lives alone,is physically