Multiple Choice

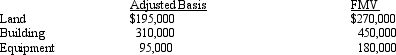

Mona purchased a business from Judah for $1,000,000.Judah's records and an appraiser provided her with the following information regarding the assets purchased:  What is Mona's adjusted basis for the land,building,and equipment?

What is Mona's adjusted basis for the land,building,and equipment?

A) Land $270,000,building $450,000,equipment $180,000.

B) Land $195,000,building $575,000,equipment $230,000.

C) Land $195,000,building $310,000,equipment $95,000.

D) Land $270,000,building $521,429,equipment $208,571.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Lynn purchases a house for $52,000. She

Q44: A taxpayer whose principal residence is destroyed

Q80: The amount of a corporate distribution qualifying

Q113: Al owns stock with an adjusted basis

Q115: If personal use property is converted to

Q118: Stocks and bonds held for investment purposes

Q119: Gabe's office building (adjusted basis of $200,000;fair

Q120: Robert and Diane,husband and wife,live in Pennsylvania,a

Q121: During 2010,Ted and Judy,a married couple,decided to

Q122: Tony's factory building was destroyed in a