Multiple Choice

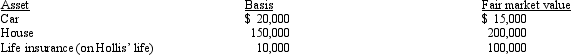

Henrietta and Hollis have been married for 10 years when Hollis dies in a sky-diving accident.Their assets are summarized below.  Henrietta and Hollis reside in Wisconsin,a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Henrietta and Hollis reside in Wisconsin,a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Car House Cash from life insurance proceeds

A) $20,000 $150,000 $ 10,000

B) $17,500 $175,000 $ 10,000

C) $17,500 $175,000 $100,000

D) $15,000 $200,000 $100,000

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: A realized loss whose recognition is postponed

Q132: A realized gain on an indirect (conversion

Q145: Nancy and Tonya exchanged assets.Nancy gave Tonya

Q146: Shontelle received a gift of income-producing property

Q148: An exchange of business or investment property

Q151: Quela,who is single,sells her principal residence which

Q152: In addition to other gifts,Megan made a

Q153: Which of the following satisfy the time

Q154: Under § 121 (exclusion of gain on

Q155: Broker's commissions and points paid by the