Essay

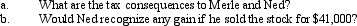

On January 15 of the current taxable year,Merle sold stock with a cost of $40,000 to his brother Ned for $25,000,its fair market value.On June 21,Ned sold the stock to a friend for $26,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q21: What types of exchanges of insurance contracts

Q27: Discuss the application of holding period rules

Q72: Felix gives 100 shares of stock to

Q75: Tricia's office building,which has an adjusted basis

Q77: Renee purchases taxable bonds with a face

Q82: Justin owns 1,000 shares of Oriole Corporation

Q110: If a taxpayer purchases a business and

Q129: Discuss the treatment of realized gains from

Q174: What effect does a deductible casualty loss

Q197: What kinds of property do not qualify