Essay

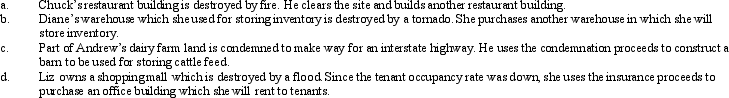

For each of the following involuntary conversions,determine if the property qualifies as replacement property.

Correct Answer:

Verified

All of the replacements qualify as repla...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

All of the replacements qualify as repla...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q11: What is the general formula for calculating

Q22: Janet, age 68, sells her principal residence

Q32: Laura transfers her personal use automobile to

Q34: Mel gives a parcel of land to

Q37: Use the following data to determine the

Q39: Hubert purchases Fran's jewelry store for $950,000.The

Q40: Melissa,age 58,marries Arnold,age 50,on June 1,2010.Melissa decides

Q49: Can related parties take advantage of the

Q119: What is the difference between the depreciation

Q190: Joseph converts a building (adjusted basis of