Multiple Choice

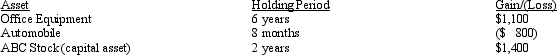

The following assets in Jack's business were sold in 2010:  The office equipment had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2010 (the year of sale) ,Jack should report what amount of net capital gain and net ordinary income?

The office equipment had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2010 (the year of sale) ,Jack should report what amount of net capital gain and net ordinary income?

A) $1,700 LTCG.

B) $600 LTCG and $300 ordinary gain.

C) $1,400 LTCG and $300 ordinary gain.

D) $2,500 LTCG and $800 ordinary loss.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: In the "General Procedure for § 1231

Q15: A retail building used in the business

Q18: Short-term capital losses are netted against long-term

Q18: Verway,Inc. ,has a 2010 net § 1231

Q45: As a general rule, the sale or

Q52: Describe the circumstances in which the maximum

Q54: Harry inherited a residence from his mother

Q67: The § 1245 depreciation recapture potential does

Q71: Short-term capital gain is eligible for a

Q119: A business taxpayer trades in a used