Essay

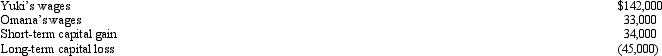

Yuki and Omana,married filing jointly,and both over 65 years of age,have no dependents.Their 2010 income tax facts are:

What is their taxable income for 2010?

What is their taxable income for 2010?

Correct Answer:

Verified

The couple's taxable income is...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Which of the following creates potential §

Q128: Jesse (now 37 years old)owns a collection

Q129: Tom has owned 20 shares of Burgundy

Q130: Vertical,Inc. ,has a 2010 net § 1231

Q131: Septa is the owner of vacant land

Q132: On August 10,2010,Black,Inc.acquired an office building as

Q135: Robin Corporation has ordinary income from operations

Q136: Residential real estate was purchased in 2007

Q137: Magenta,Inc.sold a forklift on February 12,2010,for $3,000

Q138: Phil's father died on January 10,2010.The father