Essay

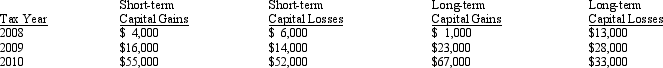

The chart below details Sheen's 2008,2009,and 2010 stock transactions.What is the capital loss carryover to 2010 and what is the net capital gain or loss for 2010?

Correct Answer:

Verified

There was a $2,000 net short-term capita...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

There was a $2,000 net short-term capita...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q22: Property sold to a related party purchaser

Q32: The Code contains two major depreciation recapture

Q41: An individual taxpayer has the gains and

Q43: Which of the following real property could

Q44: Betty,a single taxpayer with no dependents,has the

Q53: The maximum amount of the unrecaptured §

Q68: Recognized gains and losses must be properly

Q94: A net short-term capital loss first offsets

Q108: Section 1231 lookback losses may convert some

Q125: A barn held more than one year