Essay

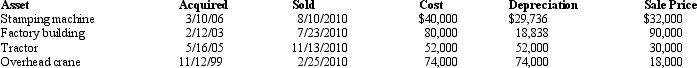

The chart below describes the § 1231 assets sold by the Burgundy Company (a sole proprietorship)this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $4,000.

Correct Answer:

Verified

The stamping machine ($21,736),tractor (...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: The three tax statuses are:<br>A)Ordinary asset,capital asset,§

Q2: Kari owns depreciable residential rental real estate

Q5: Harold is a mechanical engineer and,while unemployed,invents

Q7: In the "General Procedure for § 1231

Q14: The holding period of property given up

Q18: Short-term capital losses are netted against long-term

Q54: Harry inherited a residence from his mother

Q89: Nonrecaptured § 1231 losses from the seven

Q96: What characteristics must the seller of a

Q160: Section 1239 (relating to the sale of