Essay

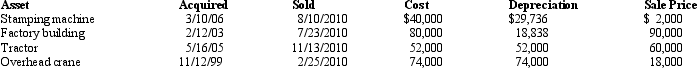

The chart below describes the § 1231 assets sold by the Bronze Company (a sole proprietorship)this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $14,000.

Correct Answer:

Verified

The stamping machine is sold at a $8,264...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Depreciation recapture under § 1245 and §

Q28: A business taxpayer sells depreciable business property

Q32: Mike is a self-employed TV technician.He is

Q32: The Code contains two major depreciation recapture

Q36: An individual taxpayer with 2009 net short-term

Q41: Personal use property casualty gains and losses

Q51: Ramon is in the business of buying

Q53: The maximum amount of the unrecaptured §

Q71: Which of the following comparisons is correct?<br>A)

Q125: When an individual taxpayer has a net