Multiple Choice

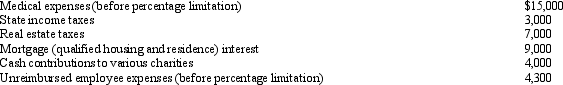

Mitch,who is single and has no dependents,had AGI of $100,000 in 2010.His potential itemized deductions were as follows:  What is the amount of Mitch's AMT adjustment for itemized deductions for 2010?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2010?

A) $14,800.

B) $16,800.

C) $19,300.

D) $25,800.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: For the ACE adjustment, discuss the relationship

Q32: Which of the following can produce an

Q33: In 2010,Daniel exercised an incentive stock option

Q34: Which of the following itemized deductions will

Q38: The net capital gain included in an

Q39: Green Corporation,a calendar year taxpayer,has alternative minimum

Q41: As to the AMT,a C corporation has

Q42: Tammy expensed mining exploration and development costs

Q55: For regular income tax purposes, Yolanda, who

Q84: Income from some long-term contracts can be