Multiple Choice

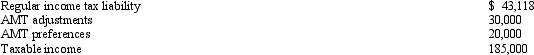

Robin,who is a head of household and age 42,provides you with the following information from his financial records for 2010.  Calculate his AMT for 2010.

Calculate his AMT for 2010.

A) $13,922.

B) $14,810.

C) $191,871.

D) $219,425.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q48: Peter incurred circulation expenditures of $210,000 in

Q49: Andrea,who is single,has a personal exemption deduction

Q51: Joel placed real property in service in

Q54: For a building placed in service before

Q55: The phaseout of the AMT exemption amount

Q56: If a single taxpayer has regular income

Q57: In 2010,Olive incurs circulation expenses of $150,000

Q69: Discuss the tax year in which an

Q82: Since most tax preferences are merely timing

Q122: Durell owns a construction company that builds