Essay

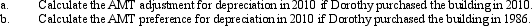

In September,Dorothy purchases a building for $900,000 to use in her business as a warehouse.Dorothy uses the depreciation method which will provide her with the greatest deduction for regular income tax purposes.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q42: Tammy expensed mining exploration and development costs

Q43: The AMT adjustment for mining exploration and

Q44: Erin owns a mineral property that had

Q45: Land that originally cost $100,000 is sold

Q46: All of a corporation's AMT is available

Q48: Peter incurred circulation expenditures of $210,000 in

Q49: Andrea,who is single,has a personal exemption deduction

Q51: Joel placed real property in service in

Q82: Since most tax preferences are merely timing

Q122: Durell owns a construction company that builds