Essay

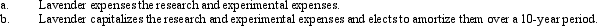

Lavender,Inc. ,incurs research and experimental expenditures of $210,000 in 2010.Determine the amount of the AMT adjustment for 2010 and for 2011 if for regular income tax purposes:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Celia and Amos,who are married filing jointly,have

Q4: If all long-term contracts are accounted for

Q5: AMT adjustments can be both positive and

Q8: During its first year of operations,Sherry's business

Q9: Calculate the AMT exemption for 2010 if

Q11: Nonrefundable personal credits are permitted to offset

Q16: Why is there no AMT adjustment for

Q40: How can interest on a private activity

Q50: What is the purpose of the AMT

Q123: The recognized gain for regular income tax