Essay

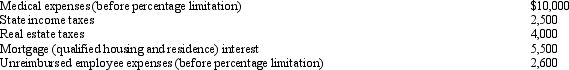

Cindy,who is single and has no dependents,has adjusted gross income of $50,000 in 2010.Her potential itemized deductions are as follows:

What is the amount of Cindy's AMT adjustment for itemized deductions for 2010?

What is the amount of Cindy's AMT adjustment for itemized deductions for 2010?

Correct Answer:

Verified

Cindy's adjustments ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: The deduction for charitable contributions in calculating

Q18: Akeem,who does not itemize,incurred a net operating

Q19: Smoke,Inc. ,provides you with the following information:<br>

Q20: If the tentative AMT is less than

Q21: The deduction for personal and dependency exemptions

Q24: The C corporation AMT rate is higher

Q26: In 2010,Glenda had a $97,000 loss on

Q27: The purpose of the AMT is to

Q28: If the taxpayer elects to capitalize intangible

Q82: The AMT does not apply to qualifying