Multiple Choice

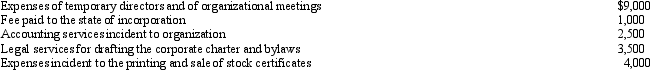

Emerald Corporation,a calendar year C corporation,was formed and began operations on July 1,2010.The following expenses were incurred during the first tax year (July 1 through December 31,2010) of operations:  Assuming a § 248 election,what is the Emerald's deduction for organizational expenditures for 2010?

Assuming a § 248 election,what is the Emerald's deduction for organizational expenditures for 2010?

A) $0.

B) $533.

C) $5,367.

D) $5,500.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q28: Copper Corporation owns stock in Bronze Corporation

Q29: Under the "check-the-box" Regulations,a single-member LLC that

Q30: Bjorn owns a 35% interest in an

Q31: Osprey Company had a net loss of

Q32: Ostrich,a C corporation,has a net short-term capital

Q34: On December 20,2010,the directors of Quail Corporation

Q35: Juanita owns 45% of the stock in

Q36: Albatross,a C corporation,had $125,000 net income from

Q37: Falcon Corporation,a C corporation,had gross receipts of

Q38: Donald owns a 40% interest in a