Essay

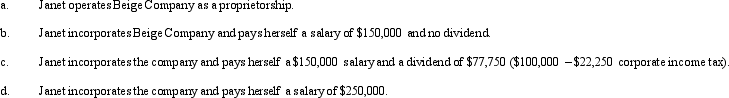

Beige Company has approximately $250,000 in net income in 2010 before deducting any compensation or other payment to its sole owner,Janet (who is single).Assume that Janet is in the 35% marginal tax bracket.Discuss the tax aspects of each of the following arrangements.(Ignore any employment tax considerations. )

Correct Answer:

Verified

Correct Answer:

Verified

Q62: Schedule M-1 of Form 1120 is used

Q63: Jessica,a cash basis individual,is the sole shareholder

Q64: Eagle Company,a partnership,had a long-term capital gain

Q65: Generally, corporations with no taxable income must

Q66: The passive loss rules apply to noncorporate

Q69: A personal service corporation with taxable income

Q70: Norma formed Hyacinth Enterprises,a proprietorship,in 2010.In its

Q71: Geneva,a sole proprietor,sold one of her business

Q72: Red Corporation,which owns stock in Blue Corporation,had

Q95: The dividends received deduction may be subject