Essay

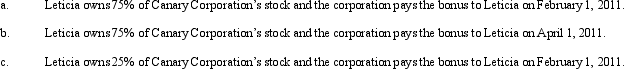

Canary Corporation,an accrual method C corporation,uses the calendar year for tax purposes.Leticia,a cash method taxpayer,is both a shareholder of Canary and the corporation's CFO.On December 31,2010,Canary has accrued a $100,000 bonus to Leticia.Describe the tax consequences of the bonus to Canary and to Leticia under the following independent situations.

Correct Answer:

Verified

Under § 267(a)(2),an accrual method taxp...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q52: On December 31,2010,Lavender,Inc. ,an accrual basis C

Q52: A corporation may elect to amortize startup

Q53: Cecelia is the sole shareholder of Aqua

Q54: Which of the following statements is incorrect

Q55: Flycatcher Corporation,a C corporation,has two equal individual

Q56: Compensation that is determined to be unreasonable

Q58: During the current year,Coyote Corporation (a calendar

Q59: Nancy is a 40% shareholder and president

Q60: Hippo,Inc. ,a calendar year C corporation,manufactures golf

Q62: Schedule M-1 of Form 1120 is used