Essay

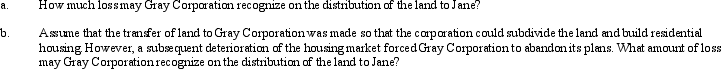

Mary and Jane,unrelated taxpayers,own Gray Corporation's stock equally.One year before the complete liquidation of Gray,Mary transfers land (basis of $300,000,fair market value of $280,000)to Gray Corporation as a contribution to capital.Assume that Mary also contributed other property in the same transaction having a basis of $10,000 and fair market value of $50,000.In liquidation,Gray distributes the land to Jane.At the time of the liquidation,the land is worth $200,000.

Correct Answer:

Verified

Note that the § 362(e)(2)basis step-do...

Note that the § 362(e)(2)basis step-do...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: A subsidiary is liquidated pursuant to §

Q30: During the current year, Ecru Corporation is

Q39: The text discusses four different limitations on

Q51: For purposes of the built-in loss limitation,the

Q53: The gain postponed by a corporation in

Q55: Corporate shareholders would prefer to have a

Q56: One similarity between the tax treatment accorded

Q57: Which of the following statements is correct

Q57: The stock of Tan Corporation (E &

Q59: Three years ago,Loon Corporation purchased 100% of