Multiple Choice

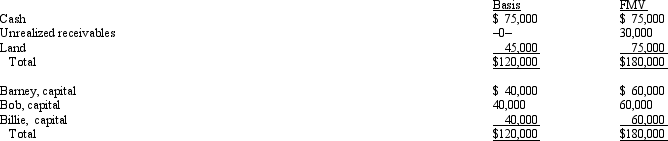

Barney,Bob,and Billie are equal partners in the BBB Partnership.The partnership balance sheet reads as follows on December 31 of the current year:  Partner Billie has an adjusted basis of $40,000 for her partnership interest.If Billie sells her entire partnership interest to new partner Janet for $60,000 cash,how much capital gain and ordinary income must Billie recognize from the sale?

Partner Billie has an adjusted basis of $40,000 for her partnership interest.If Billie sells her entire partnership interest to new partner Janet for $60,000 cash,how much capital gain and ordinary income must Billie recognize from the sale?

A) $20,000 ordinary income.

B) $20,000 capital gain.

C) $10,000 ordinary income;$10,000 capital gain.

D) $30,000 ordinary income;$10,000 capital loss.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Martin has a basis in a partnership

Q43: Which of the following statements about the

Q45: MEM Partners was formed during the current

Q47: Which of the following is not typically

Q49: The JIH Partnership distributed the following assets

Q50: In computing the ordinary income of a

Q51: Denise invested $30,000 this year to purchase

Q52: Richard made a contribution of property to

Q63: Which of the following statements is true

Q82: In a proportionate liquidating distribution, Scott receives