Essay

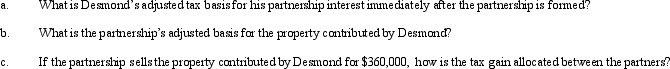

Joel and Desmond are forming the JD Partnership.Joel contributes $300,000 cash and Desmond contributes nondepreciable property with an adjusted basis of $80,000 and a fair market value of $330,000.The property is subject to a $30,000 liability,which is also transferred into the partnership and is shared equally by the partners for basis purposes.Joel and Desmond share in all partnership profits equally except for any precontribution gain,which must be allocated according to the statutory rules for built-in gain allocations.

Correct Answer:

Verified

Correct Answer:

Verified

Q28: In a proportionate liquidating distribution, UVW Partnership

Q31: Section 721 provides that no gain or

Q52: Partner Tom transferred property (basis of $20,000;

Q56: For purposes of determining gain on a

Q78: Wendy receives a proportionate nonliquidating distribution from

Q79: Holly and Marcus formed a partnership.Holly received

Q80: When property is contributed to a partnership

Q84: Bradley owns a one-third interest in a

Q89: Henry contributes property valued at $60,000 (basis

Q92: For income tax purposes, proportionate and disproportionate