Essay

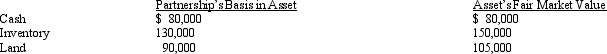

Suzy owns a 25% capital and profits interest in the calendar-year SJDV Partnership.Her adjusted basis for her partnership interest on July 1 of the current year is $200,000.On that date,she receives a proportionate nonliquidating current distribution of the following assets:

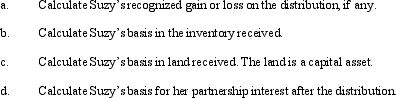

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Bill's basis in his 20% interest in

Q33: Morgan and Kristen formed an equal partnership

Q34: Generally,gain is recognized on a proportionate current

Q36: On the first day of the current

Q38: On January 1 of the current year,Sarah

Q39: In a proportionate liquidating distribution in which

Q40: Your client has operated a sole proprietorship

Q41: Marilyn is a partner in a continuing

Q42: Which of the following statements correctly reflects

Q46: Which of the following statements is always