Essay

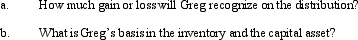

In a proportionate liquidating distribution in which the partnership is liquidated,Greg received cash of $20,000,inventory (basis of $2,000,fair market value of $3,000),and a capital asset (basis and fair market value of $4,000).Immediately before the distribution,Greg's basis in the partnership interest was $30,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q32: One of the disadvantages of the partnership

Q44: A partnership must provide any information to

Q57: If the partnership properly makes an election

Q135: Kevin,Chuck,and Greg contributed assets to form the

Q136: Partner Bob purchased his partnership interest for

Q137: Roger is a 30% partner in the

Q139: A general partnership is similar to a

Q140: Items that must be passed through separately

Q142: Barry owns a 25% interest in a

Q143: Marcie is a 40% partner in the