Essay

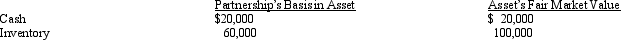

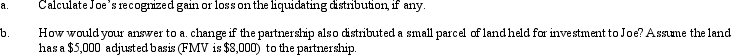

Joe has a 25% capital and profits interest in the calendar-year GDJ Partnership.His adjusted basis for his partnership interest on October 15 of the current year is $200,000.On that date,the partnership liquidates and makes a proportionate distribution of the following assets to Joe.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: A partner has a profit-sharing percent, a

Q32: One of the disadvantages of the partnership

Q139: A general partnership is similar to a

Q140: Items that must be passed through separately

Q142: Barry owns a 25% interest in a

Q143: Marcie is a 40% partner in the

Q145: Cardinal,LLC incurred $20,000 of startup expenses,$3,000 of

Q146: Jackie owns a 40% interest in the

Q147: Which of the following statements,if any,about an

Q148: Which of the following is a correct