Multiple Choice

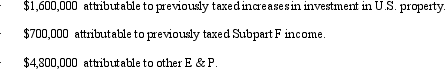

\Benchmark,Inc. ,a U.S.shareholder owns 100% of a CFC from which Benchmark receives a $3 million cash distribution.The CFC's E & P is composed of the following amounts.  Benchmark recognizes a taxable dividend of:

Benchmark recognizes a taxable dividend of:

A) $3 million.

B) $700,000.

C) $2,300,000.

D) $0.

Correct Answer:

Verified

Correct Answer:

Verified

Q21: USCo, a domestic corporation, receives $700,000 of

Q111: WorldCo, a foreign corporation not engaged in

Q128: Amelia,Inc. ,a domestic corporation receives a $100,000

Q130: Wallack,Inc. ,a U.S.corporation,owns 100% of Orion,Ltd. ,a

Q131: The source of income received for the

Q132: Abe,a U.S.shareholder under the CFC provisions,owns 49%

Q134: A Qualified Business Unit of a U.S.corporation

Q135: Miles is a citizen of France and

Q136: Which of the following persons are typically

Q137: A "U.S. shareholder" for purposes of CFC