Essay

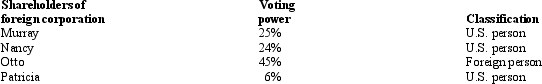

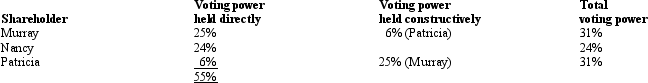

Given the following information,determine if FanCo,a foreign corporation,is a CFC.

Patricia is Murray's daughter.

Patricia is Murray's daughter.

Correct Answer:

Verified

Murray,Nancy,and Patricia are U.S.shareh...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Which of the following is not a

Q25: Which of the following statements best describes

Q39: Discuss the primary purposes of income tax

Q73: ForCo,a foreign corporation not engaged in a

Q76: Which of the following statements regarding a

Q77: Collins,Inc.received gross foreign-source dividend income of $250,000.Foreign

Q78: Which of the following statements concerning the

Q79: Austin,Inc. ,a domestic corporation,generates U.S.-source and foreign-source

Q82: Which of the following is a principle

Q121: ForCo, a foreign corporation, receives interest income