Essay

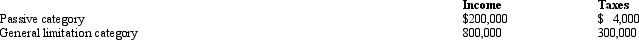

BendCo,Inc. ,a U.S.corporation,has foreign-source income and pays foreign taxes as follows.

BendCo's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume 35%).What is BendCo's U.S.tax liability after the FTC?

BendCo's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume 35%).What is BendCo's U.S.tax liability after the FTC?

Correct Answer:

Verified

FTC-passive basket

FTC is lesser of fore...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

FTC is lesser of fore...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: Which of the following is not a

Q119: Interest paid to an unrelated party by

Q121: During 2010,Martina,an NRA,receives interest income of $50,000

Q122: Dividends received from a domestic corporation are

Q123: Performance,Inc. ,a U.S.corporation,owns 100% of Krumb,Ltd. ,a

Q125: If Polka,Inc. ,a U.S.taxpayer,pays foreign taxes of

Q126: In all cases,the sourcing of income is

Q127: In allocating interest expense between U.S.and foreign

Q128: Amelia,Inc. ,a domestic corporation receives a $100,000

Q137: A "U.S. shareholder" for purposes of CFC